This is a complete transcript and audio recording (12 minutes) of the presentation by Budget Administrator Bradley Johnson at yesterday’s special meeting of the Oakland City Council. Mr. Johnson summarized the state of the city’s finances and urgent actions required to address the fiscal crisis. He notes that $115M must be cut from spending this year, and $140M from next year’s (FY25-26) budget to avoid insolvency.

Thank you. Director Roseman, Brad Johnson, budget administrator.

The report contains detailed information on our projected expenditures in the General Purpose Fund for city departments. In total, the General Purpose Fund is expected to exceed its now-adjusted budget by $93.4 million, which is 12% higher than that adjusted budget number.

The largest contributors to that overspending, and the two largest departments in your General Purpose Fund, are your Fire Department, which is projected to overspend by $34.5 million, or 21% of its budget, and your Police Department, which is expected to overspend by $51.9 million, or 16% of its budget.

Again, overspending in total is $93.4 million. Detailed information on those departments is available in the report. I would recommend everyone, as opposed to looking at the screen, look at the detailed report for that information, and information on all other departments is noted.

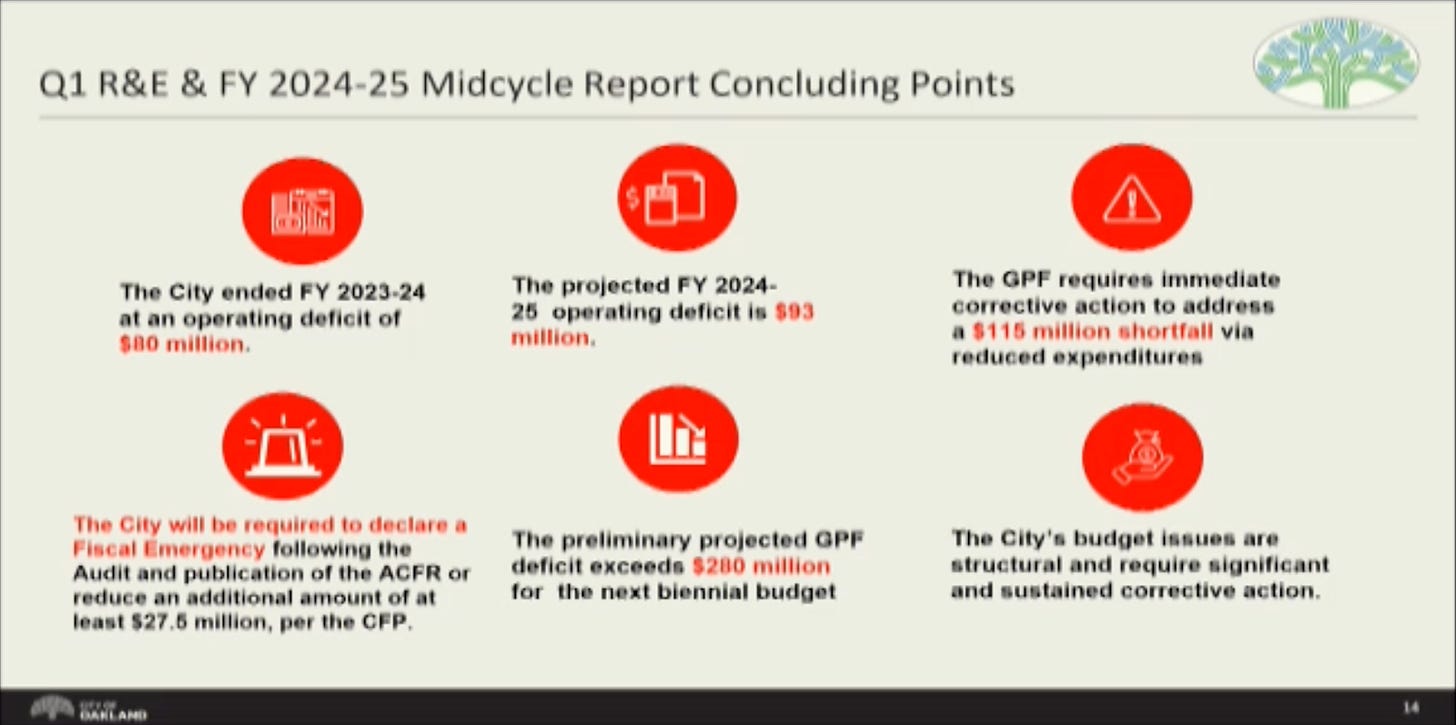

Discussing where we are projected to end the current fiscal year: we ended last fiscal year in a negative position. This is one of the first times ever we have seen this actually happen. That negative position last year was driven by an operating deficit of $80 million, meaning that last year we took in $80 million less in the General Purpose Fund than we outlaid.

This year, we are projecting our operating deficit to be $93 million. So, consistent with that last year's $80 million operating deficit, we are seeing a $93 million operating deficit this year.

After we note some excess fund balance coming back from our equipment fund and reserves required amounts for legal settlements and the expended, already carried forward allocations, we are projecting to end at roughly $115 million in the negative at the end of this fiscal year, if no action is taken.

I want to be clear about what this number means. These are trends based on your actuals. This already incorporates the fact that we have many positions in the General Purpose Fund vacant. It already incorporates the revenue trends that Director Roseman mentioned. It already incorporates the reimbursable reimbursements for OPD overtime that was mentioned at the Finance Committee earlier.

Based on our current trend, if we do not change course, we will be roughly $115 million negative.

We mentioned we ended last year in the negative position. That negative position was substantial enough that the city is now, when combining its undesignated fund balance in the General Purpose Fund—this is still an unaudited number—we have effectively tapped into our mandated emergency reserve under the Consolidated Fiscal Policy.

We have negatives. We have reserves also for OMERS, as required by that resolution for a closed retirement system, and we have a small cash balance that's due to interest in our Vital Services Stabilization Fund. But the highlight here is we have already breached into our emergency reserve.

This is, again, based on transactions that occurred last fiscal year, not ones that are forthcoming, but what we've already seen. And, again, this is the first time we've ever seen this occur since we've had this policy. I will note that this is all governed by your Consolidated Fiscal Policy.

Other funds are noted in this report. There are positive fund balances in some of these funds. These positive balances are due to prior years' overspending. They may be due to delayed expenditures. Certainly, in some of our capital funds, we have ongoing and delayed projects. However, some of these funds are also negative, and the cost pressures facing the General Purpose Fund are also facing these funds as well.

To summarize where we sit as an organization: we have a general negative General Purpose Fund balance that's accumulated from FY23-24. We are projecting overspending this year by $93 million, and we have limited time by which to take corrective action.

That corrective action is required to happen before December 31 of this year. It must happen this calendar year if the action is going to have sufficient time to effectuate change over the course of the remaining six months of the fiscal year. The resources that we need to bring in, the actions we need to take, need to be immediate.

We are limited in what we can do. We must consider existing resources that we have on hand, unrestricting them and making them available to help balance the General Purpose Fund. We need to consider any revenues which can absolutely be recognized this fiscal year, but that precludes revenues that would be liens because those liens will take effect after the next tax roll, which is after the end of the conclusion of this fiscal year.

Similarly, we could consider, for long-term fiscal circumstances, ballot measures, but, again, the tax roll will not be levyable until next fiscal year, which means we are left with making the majority of these corrective actions via reductions to expenditures.

Your staff recommends that you, as policymakers, our residents, and all stakeholders seriously grapple with these financial circumstances. We need to address this immediately and urgently to avoid possible future negative fiscal consequences.

<Oh, I lost the screen. I'm not sure what occurred there. Oh, there we go.>

The fiscal circumstances in the current fiscal year are dire, but they are not unique. We are estimating preliminarily now that our deficit in the coming fiscal year will be $130 million and grow to $150 million. Those deficit numbers will continue to grow.

I want to actually note something that Councilman Kaplan brought up when we were discussing OPD overtime at the prior Finance Committee meeting. We noted that our burden rates for benefits are 80% because we retain significant unfunded amounts and are not 100% funded in our CalPERS pension and our OPEB amounts.

That burden rate is going to continue to increase until it goes far past one to one. That is the impact of not having fully funded retirement systems, and that will, again, begin to slowly eat at our ability to have resources to provide services.

Our baseline reflects an ongoing imbalance between what we expend and what we take in. That needs to be corrected to restore sustainability. We need to adopt a comprehensive, ongoing balancing approach for measures that are both feasible in the medium term and sustainable in the long term.

We need to recommit to our practices. We need to rebuild our reserves. We need to use only ongoing resources for ongoing expenditures and make hard decisions in the moment to restrict our ongoing expenditures to the totality of those ongoing resources.

We need to ensure that our services align with the budget. We need to pay down our long-term liabilities. We can no longer afford to have long-term outstanding balances with CalPERS and with OPEB. We need to ensure that our long-term ability to pay matches our long-term ability to generate resources.

In conclusion, the city ended an operating deficit of $80 million last year. This year's operating deficit is $93 million. The collective shortfall we need to resolve to ensure the solvency of our General Purpose Fund is $115 million that must be resolved this fiscal year with actions available to us as an organization this fiscal year, which means we must take action urgently if we wish to not declare a fiscal emergency, which will be triggered under our CFP based on how we ended last fiscal year.

We need to add another $27 million to that $115 million and balance it this year. Your deficit over the next biennial was $280 million. There is no long-term rescue coming for us.

And I will editorialize right now: this report considers current trends. We have an exceedingly scary outlook at the federal level right now. The impacts that will come from potential reductions to federal grant expenditures, things like HOME and CDBG and Head Start, is noted.

The crowding-out effect on interest rates that will depress our real estate market from large tax cuts is not included here. The economic impact of a potentially 20% tariff across the board and what it will do to our local economy is not noted here, much less what it will do to our expense costs.

And while I struggle personally to deal with the potential impacts of proposed immigration enforcement, as noted on all of us, on a moral and personal level, the economic impacts of a tenth of that action will make the other things I've noted look small. None of that is yet factored in.

There are downside outlooks that we need to consider as well. We have a significant preexisting structural issue as an organization to maintain our solvency. Now is the time that we have to take action to solve it.

I will take a personal liberty at this time before I close. Councilman Gallo, you have asked on repeated occasions from us to let you know when it is critical that we take action. I want you to hear clearly at this dais that we must take action over the course of the next month and a half to preserve our solvency.

I want to make sure. I want to make sure that that is very clear.

With that, we'll conclude, and I am happy to take any questions you may have.

Share this post